nfa tax stamp trust vs individual

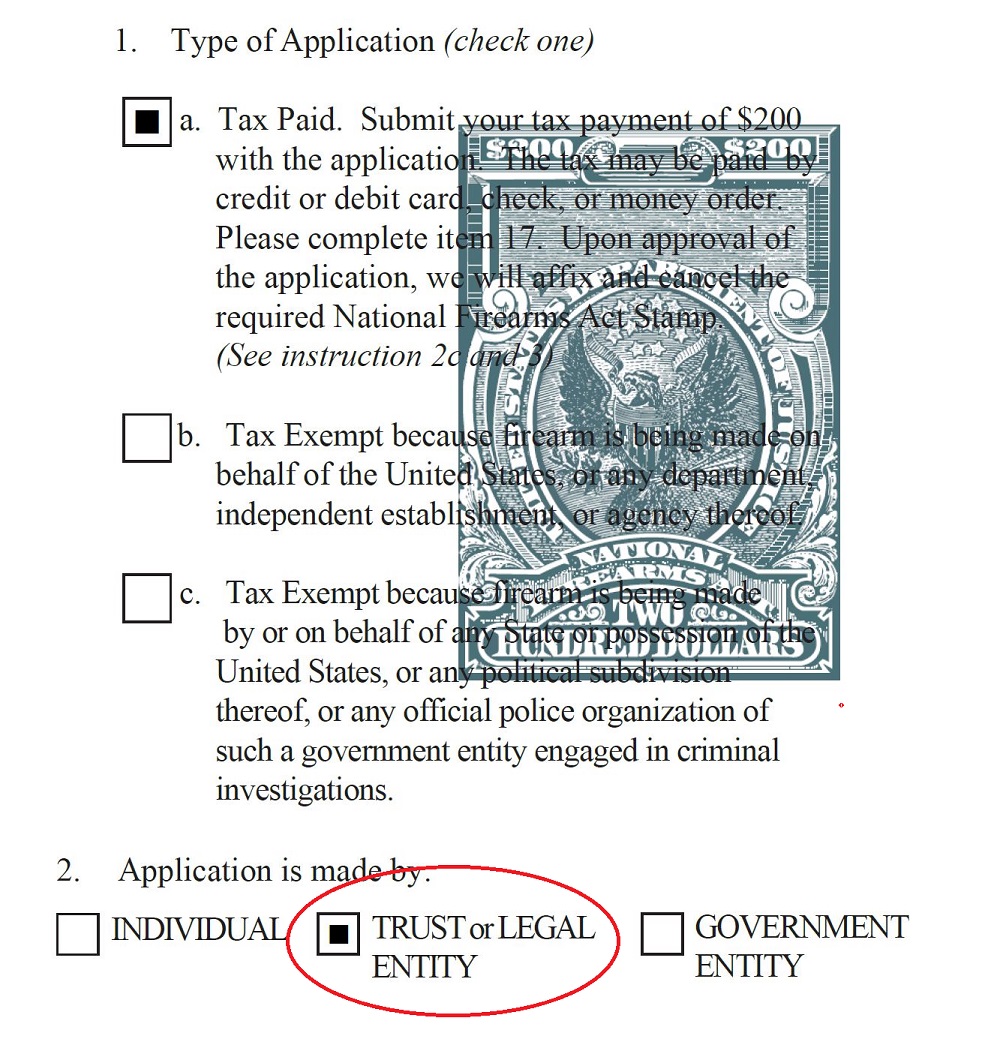

Yes you can transfer your individual tax stamp into a gun trust corporation or other legal entity. Form 4 Page 2.

Atf Tax Stamp Application Process Flow Chart National Gun Trusts

An NFA Gun Trust is a legal instrument with the capability of owning an NFA firearm.

. At the time of this writing individual Form 4s are transferring a couple of months faster than for trusts. As an individual the wait time for a tax stamp on a Form 4 is 10 month or more. Its easier and simpler to file as an individual a tiny bit cheaper and some claim faster approvals.

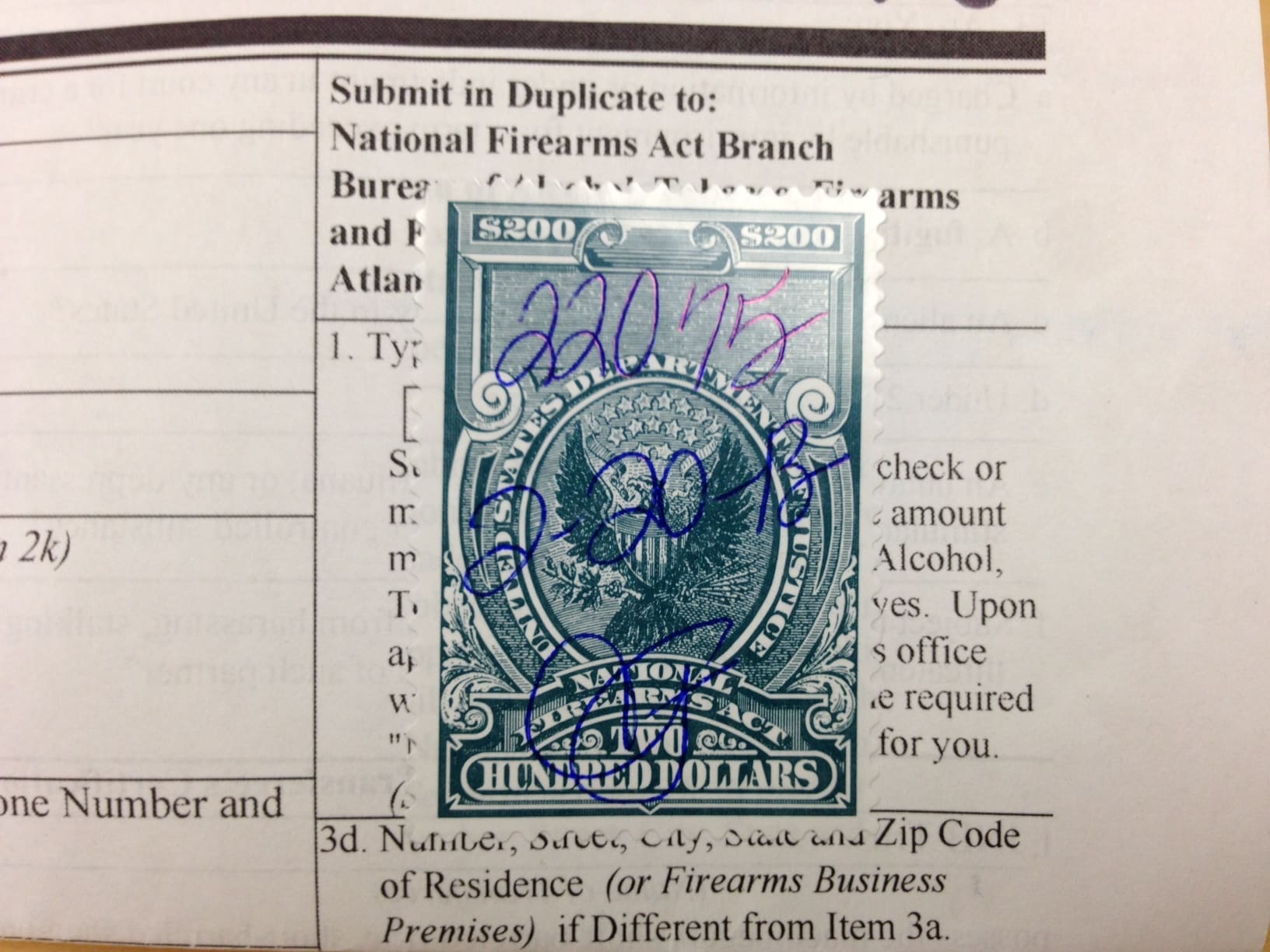

Just called ATF 304-616-4500 and got it all explained. When an NFA Gun Trust is the lawful owner of an NFA weapon multiple people may. In most cases the Tax Stamp is 200 but if you purchase an AOW the.

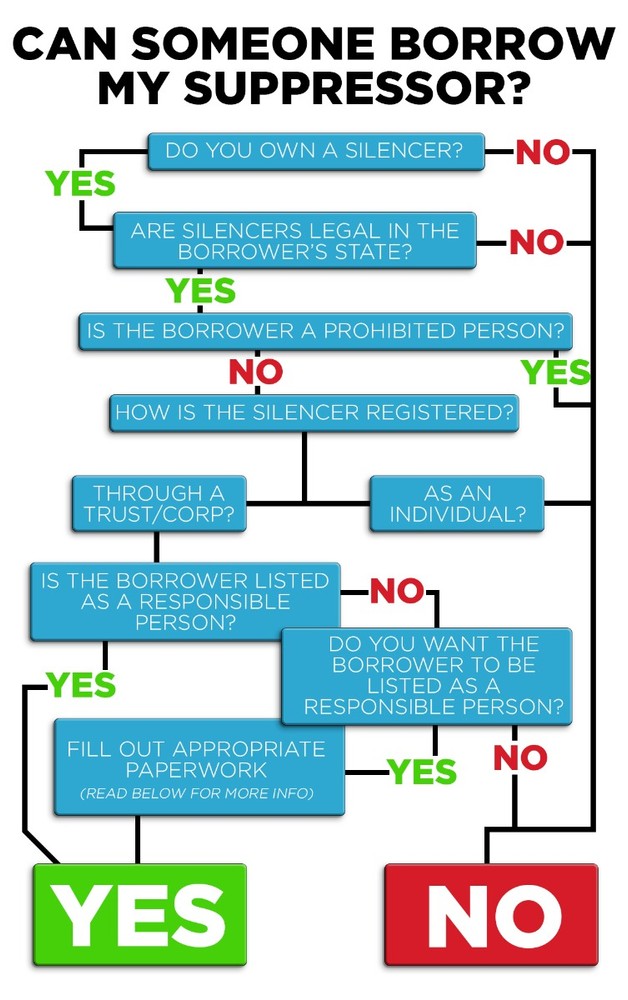

Yes for every firearm being transferred to the trust a separate 200 tax stamp will be required. I was agreeing that for the two form types to be at pace with one another more filings would have to be reviewed and. Without a Trust the person that got the Tax Stamp and purchased the suppressor MUST BE PRESENT.

The requirement of a tax stamp is triggered by a transfer Be careful because ATF treats foot. A trust makes it easier to share the fun and benefits of shooting with suppressors. Re-file every Form 4 and pay another 200 per stamp.

Gun Trust USA is perhaps the first and only provider of NFA trust solutions to educate the public about the benefit of using multiple NFA trusts. We believe there are very. However since you are transferring the NFA firearm from one entity.

Box 10 should contain your name as it appears on the current tax stamp followed by - SELF. - Upon death NFA items can be transferred to your heir tax free with a ATF Form 5 53205 Cons. If youd like to learn more.

A trust only makes sense if you want others to take your NFA items unsupervised. Put yourself as the transferor and your. The ratio of trust to individuals would be different.

Box 12 should contain. Sure you can transfer your individually registered items to a trust but the process is no different. Yes The Tax Stamp is for the ability to transfer a Title II firearms to an individual business entity or trust.

- Must get fingerprinted for each NFA application - Must get CLEO sign-off -. Box 11 should contain the current date. Moving a suppressor from an individual registration to a trust or corporation requires an additional 200 tax stamp.

One DOES NOT list on Schedule A a firearm or receiver that is intended to be converted into SBR. As an FFL using a Form 3 the wait time is usually only a day or two. In legal terms each person is a separate entity from the trust which.

It will be transferred. Use a revocable trust so that youre not transferring the NFA item. Keep in mind that its your responsibility to ensure the.

This is likely due to the internal division of labor in the ATF and the fact.

A Buyer S Guide Individual Vs Trust

Atf Form 1 Everything You Need To Know Silencer Central

Ultimate Guide On What Is An Nfa Tax Stamp And How To Fill The Atf Eform 1 For Nfa Tax Stamp Application F5 Mfg

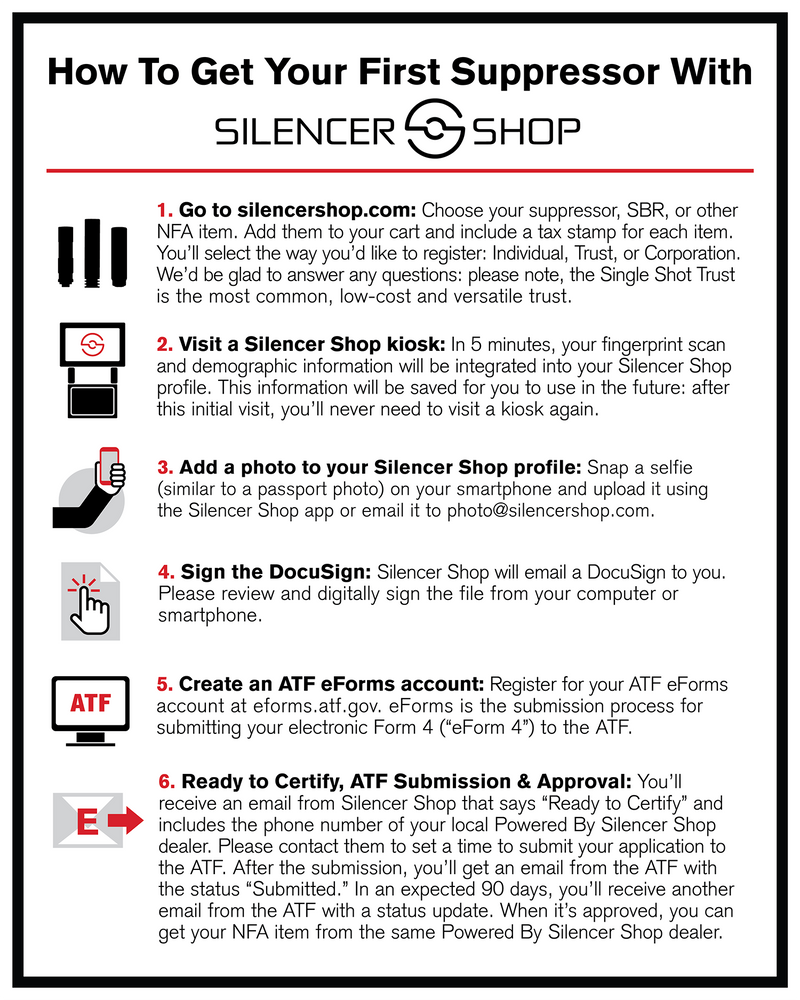

How To Buy A Silencer In 6 Simple Steps Silencer Shop

How To Get A Suppressor Tax Stamp Silencer Central

What S An Nfa Gun Trust And Why Use One 80 Lowers

Who Is Allowed To Shoot Or Use My Silencer

Nfa Tax Stamp How To Get A Suppressor Or Sbr Tax Stamp 2022 Rocketffl

New Updated 2022 Atf Eform 1 Gun Trust Sbr Video Walk Through Guide National Gun Trusts Youtube

What Is A Gun Trust Az Gun Law

Why Choose A Nfa Gun Trust Instead Of Filing Individually For Your Atf National Gun Trusts

How To Fill Out Atf Form 1 Employer Identification Number Form Filling

Gun Trusts 14 Points Why A Gun Trust Is The Best Way To Get Your Nfa Item

Atf Form 1 Nfa Tax Stamp Walk Through Guide R Nfa

Best Nfa Gun Trusts 2022 Should You Get One Gun University

A Buyer S Guide Individual Vs Trust

How To Buy A Suppressor Using An Nfa Trust The Truth About Guns

Why Choose A Nfa Gun Trust Instead Of Filing Individually For Your Atf National Gun Trusts