texas property tax lien loans

A tax lien is a legal claim against property or. Your local tax agency may be able to provide information on when tax lien auctions take place according to the National Tax Lien Association NTLA.

What Are Tax Liens And How Do They Work The Pip Group

After receiving your last payment your lienholder will have 10 business days to release the lien.

. Weve helped thousands of Texans save time and money with Texas property tax loans. This document includes details of the property the amount owed and any additional charges such as interest. A All real and tangible personal property that this state has jurisdiction to tax is taxable unless exempt by law.

County Median Home Value Median Annual Property Tax Payment Average Effective Property Tax Rate. For example whenever a lender provides funding for the borrower to buy a car house or other significant assets they place a lien on the property so that if the property owner defaults on the loan and doesnt pay the creditor back the financier can sell the property and collect their funds. TAXABLE PROPERTY AND EXEMPTIONS.

If the lien is not satisfied. The TX car title certificate. And theres a property tax lien on your home for 15000.

Failing to pay your property taxes can result in the taxing authority placing a tax lien on the property. The creation of a tax lien and the subsequent issuance of a Notice of Federal Tax Lien should not be confused with the issuance of a Notice of Intent to Levy under 26 USC. To home equity loans.

Any other loans you take out on the home such as a home equity credit line act as a second lien. Removing a Lien from a TX Title. 6331d or with the actual act of levy under 26 USC.

A On January 1 of each year a tax lien attaches to property to secure the payment of all taxes penalties and interest ultimately imposed for the year on the property whether or not the taxes are imposed. If you have an electronic title your lienholder will then simply remove the lien electronically and notify you once the lien release is complete. Child Support Liens Under Texas law its possible to obtain a lien for unpaid child support.

One mill is equal to 1 of tax for every 1000 in assessed value. The government issues a tax lien certificate when the lien is placed on the property. Manufactured Housing Unit Supplemental Coverage Endorsement T-311 Cost.

REAL AND TANGIBLE PERSONAL PROPERTY. As we covered in How to Get Rid of Property Tax Liens in Texas a lien is a local state or federal governments legal claim against your property when your taxes arent paid. A lien is a legal claim over an asset held as collateral.

Ohio Property Tax Rates. TAXABLE PROPERTY AND EXEMPTIONS. Property tax rates in Ohio are expressed as millage rates.

Because of the differences in assessed value described above millage rates in one county cannot be directly compared to another. Weve helped thousands of Texans. You cannot sell the property without first satisfying the lien by paying the debt back.

TAX LIENS AND PERSONAL LIABILITY. Unlike other types of tax liens the property tax lien is usually only attached to the property that has unpaid taxes. 5000 When NeededWhen an insured loan is secured by a manufactured housing unit that has been designated as real property or paperwork required to designate the MHU as real property will be processed and perfected as part of the closing.

If youre interested in tax lien investing the first step is finding tax liens for sale at auction. It generally means other property is safe from collection relating to the tax lien. Governments legal claim against your property when you dont pay a tax debt.

Rates vary by school district city and county. In Texas the foreclosure process can start at any time. Pursuant to Texas Occupations Code chapter 1201206 g and Texas Property Tax Code section 3203 a-2 a person may not transfer ownership of a manufactured home until all recorded tax liens have been released and all taxes which accrued within the 18 months preceding the date of the sale have been paid.

The process can be completed in about 60 days if the foreclosure is uncontested. If you owe a hospital a substantial amount of money for uninsured medical expenses it can pursue the debt including placing a lien on your house. A property tax lien is a lien placed on real estate when the property taxes havent been paid.

Many creditors can put liens on your home or other property making the title to the property encumbered. Once you know when a tax lien auction is scheduled you can plan to attend. In one sense thats good news.

The difference between a federal tax lien and an administrative levy. The mortgage lender then records this loan known as a first mortgage effectively putting a lien on the property. Its easy to pay off your property taxes when you call Tax Ease.

Federal Tax or IRS Liens A federal tax lien is the US. With three base locations in Dallas Houston and McAllen TX we provide hassle-free Texas property tax loans for residential or commercial property owners. If your vehicle has a paper title the lienholder must mail you.

All the profit and then some goes to the lien. Property Tax Liens This is a legal claim against a property for unpaid property taxes.

Dream Franchise Real Estate Tax Lien Loans Property Tax Protesting In Richardson Texas Bizbuysell

Benefits Of Texas Property Tax Loans Texas Property Tax Funding

Property Tax Lenders Hunter Kelsey

Texas Property Tax Loans Delinquent Property Taxes

Benefits Of Texas Property Tax Loans Texas Property Tax Funding

Property Tax Lenders Learn About Texas Property Tax Loans Lenders Tax Ease

Benefits Of Texas Property Tax Loans Texas Property Tax Funding

Texas Property Tax Loans Learn Everything About Property Tax Loans In Texas Tax Ease

Tax Foreclosure Texas National Title

Texas Tax Lien Deeds Real Estate Investing Financing Book How To Start Finance Your Real Estate Investing Small Business Mahoney Brian 9781537471334 Amazon Com Books

Texas Tax Lien Deeds Real Estate Investing Financing Book How To Start Finance Your Real Estate Investing Small Business Mahoney Brian 9781537471334 Amazon Com Books

Dream Franchise Real Estate Tax Lien Loans Property Tax Protesting In Richardson Texas Bizbuysell

Property Tax Lending Vs Tax Lien Transfers What S The Difference

Texas Property Tax Loans Delinquent Property Taxes

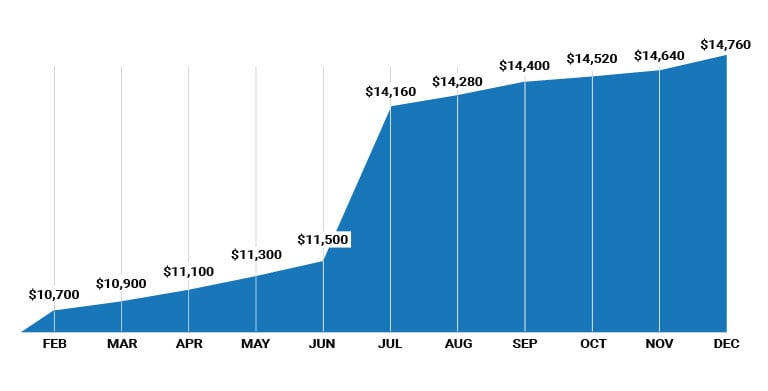

Penalties For Failure To Pay Property Taxes Texas Property Tax Loans

Texas Property Tax Loans Delinquent Property Taxes

Dream Franchise Real Estate Tax Lien Loans Property Tax Protesting In Richardson Texas Bizbuysell

Property Tax Financing Learn About Texas Property Tax Financing From Tax Ease